Can AI ETFs Hedge the AI Revolution?

- Jun 16, 2025

- 2 min read

Updated: Jul 1, 2025

As artificial intelligence begins to reshape entire sectors, a growing number of investors, operators, and even corporate strategists are asking the same question:Can you hedge the risk of AI disruption by investing in AI itself?

The logic seems sound. If you work in an industry likely to be impacted — whether it’s software engineering, education, design, logistics, or even finance — then gaining exposure to AI-related assets could be a strategic hedge. If your role, revenue, or business model is at risk from automation or generative AI, then why not balance that risk by owning a slice of the tools doing the disrupting?

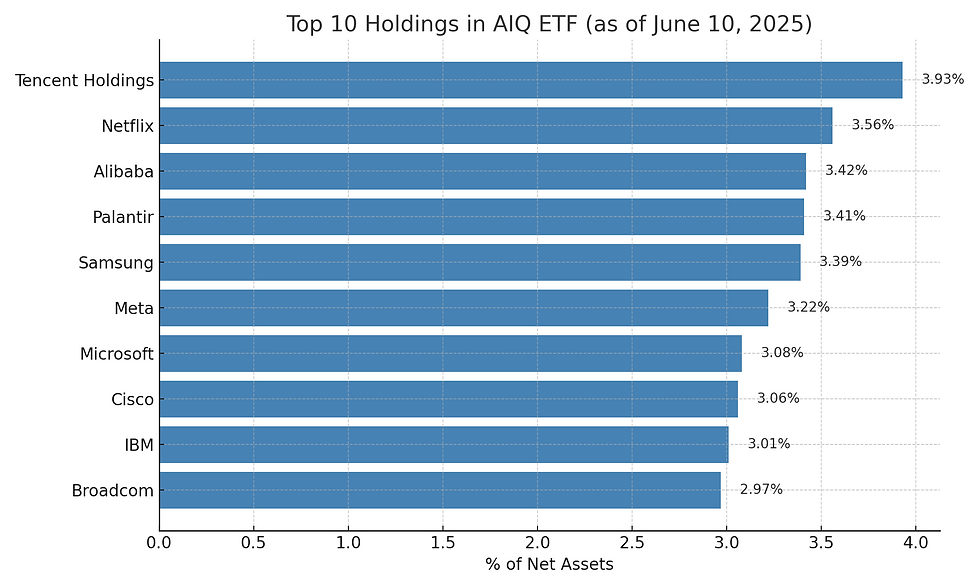

In theory, AI-themed ETFs (exchange-traded funds) offer an accessible way to do this — without the concentration risk of betting on a single stock like Nvidia. But how well do these funds actually perform? And more importantly, do they truly track the AI economy?

A Mixed First Year

Looking at performance over the past 12 months (as of June 13, 2025), results are mixed:

Fund / Index | Symbol | 1Y Return | Focus Area |

Nvidia Corp. | NVDA | +7.65% | Number 1 AI stock |

NASDAQ Composite Index | IXIC | +7.34% | Market benchmark |

Global X Artificial Intelligence & Tech ETF | AIQ | +16.23% | Broad AI software, cloud, semiconductors |

iShares Future AI & Tech ETF | IAUF | +12.97% | Diversified AI, automation, data tools |

First Trust Nasdaq AI & Robotics ETF | ROBT | +7.11% | Robotics + AI blend |

Global X Robotics & AI ETF | BOTZ | –1.72% | Robotics-heavy exposure |

TheMarketAI.com Take

For anyone thinking about AI exposure as a hedge — not just an investment opportunity — the past year provides more questions than answers.

So far, the results suggest that most AI ETFs mirror, rather than hedge against, the broader tech cycle. They're not immune to macro volatility or index correlation. And in many cases, they still derive performance from the same few companies driving the narrative — Nvidia, Microsoft, AMD, Alphabet — with a lot of filler in between.

But we believe the hedging conversation is just beginning. In a world where AI is accelerating unevenly, the need to create exposure to its upside — especially for those most at risk of its downside — will only grow.

We plan to track these ETFs and others over time to see whether new vehicles emerge that offer more targeted exposure to the real drivers of AI disruption — or whether passive instruments will continue to offer diluted, inconsistent access to the AI future.

Source: Public market data as of June 16, 2025. ETF holdings based on latest public disclosures. Nvidia performance via Google Finance trailing 12-months.

Disclaimer:The content provided on TheMarketAI.com is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities. Always conduct your own research and consult a licensed financial advisor before making investment decisions.