Nearly Half of Q2 Venture Dollars Flowed Into AI, Fueling Industry boom

- Niv Nissenson

- Jul 9

- 1 min read

Venture capital activity was largely propelled by massive bets on artificial intelligence, according to a report by Fortune citing data from Crunchbase.

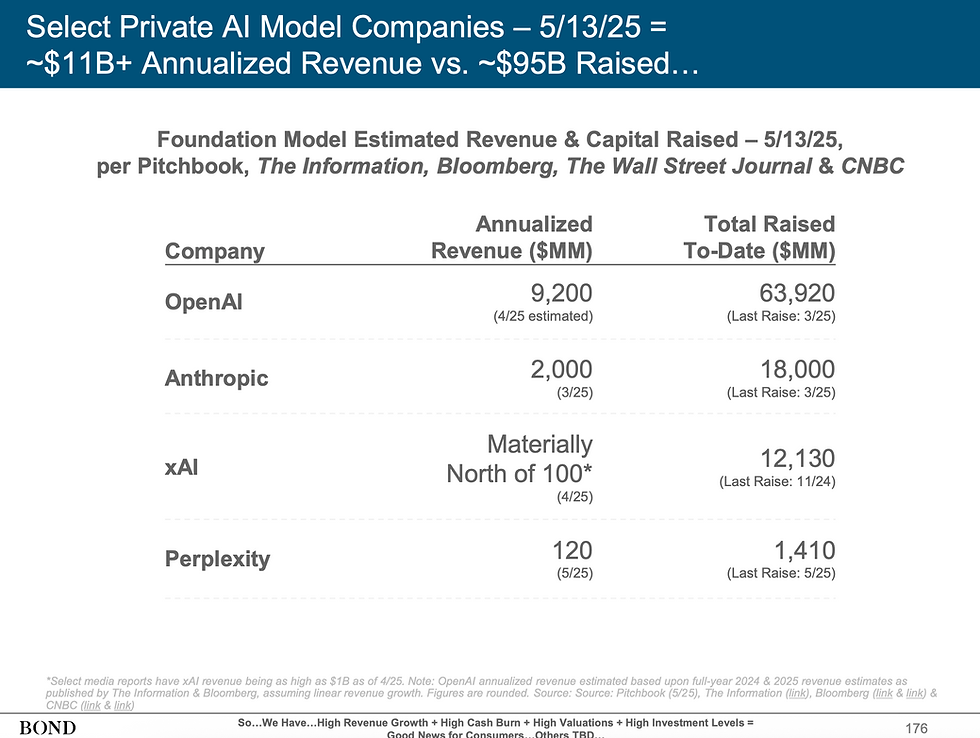

Startups raised $91 billion in venture funding last quarter—up roughly 11% from the same period last year, though still below the $114 billion high of Q1. Nearly half of Q2’s total came from AI deals, which attracted $40 billion. The standout was Meta’s $14.3 billion investment in Scale AI, accounting for over a third of AI sector funding.

Other large rounds included $2.5 billion for defense-tech firm Anduril Industries, and $2 billion each for Thinking Machines Labs both of which aim to advance foundational AI capabilities.

Crunchbase noted that global startup funding has now grown year-over-year for three straight quarters, “driven primarily by billion-dollar-plus rounds into AI research labs as well as data and infrastructure providers.” We've seen data centers and hyperscalers seem to be early winners in the AI boom.

Beyond venture funding, startup exits also picked up. Q2 saw $50 billion in reported M&A value, led by OpenAI, which completed four acquisitions, including Jony Ive’s io for $6 billion and Windsurf for $3 billion.

TheMarketAI.com Take

As we’ve highlighted before, AI is a once-in-a-generation boom with the power to reshape entire industries and redefine tech’s winners and losers. With AI already accounting for roughly half of all venture capital spending today, we wouldn’t be surprised to see that share climb even higher in the quarters ahead.